Business Insurance in and around Shreveport

One of the top small business insurance companies in Shreveport, and beyond.

Cover all the bases for your small business

State Farm Understands Small Businesses.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, business continuity plans and extra liability coverage, among others.

One of the top small business insurance companies in Shreveport, and beyond.

Cover all the bases for your small business

Insurance Designed For Small Business

Whether you own a pet groomer, an ice cream shop or an art gallery, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

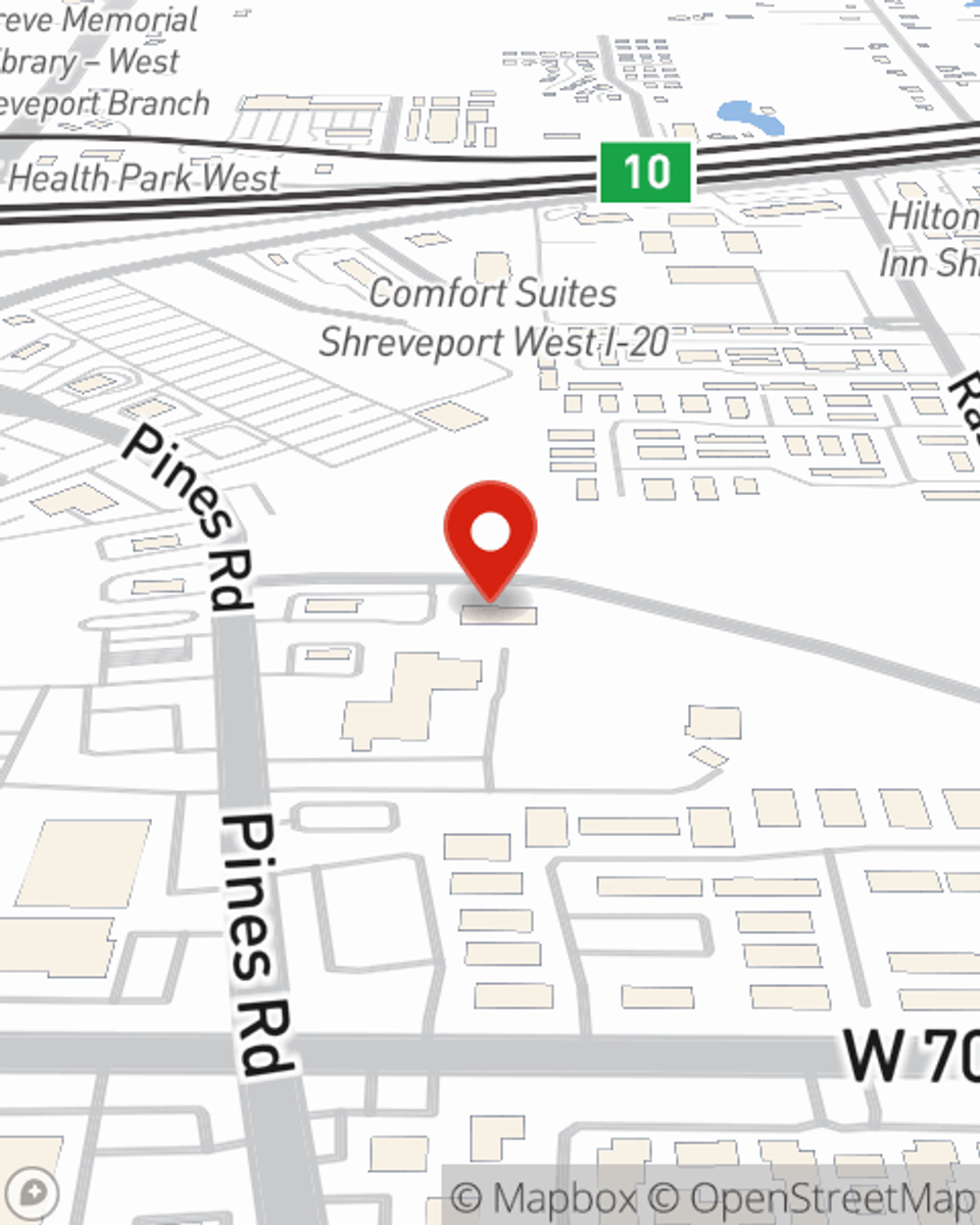

Ready to discuss the business insurance options that may be right for you? Get in touch with agent Nora Brooks's office to get started!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Nora Brooks

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.